Click here to view PDF.

“Both optimists and pessimists contribute to society. The optimist invents the aeroplane, the pessimist the parachute.” George Bernard Shaw

The fourth quarter of 2018 represented an abrupt departure from the narrative in place for financial markets over the course of this economic cycle with US equities experiencing the worst quarterly return since the third quarter of 2011 and December alone representing the worst month for US stocks since October 2008. More challenging, negative returns from broad fixed income markets over the course of the year have resulted in diversified portfolios experiencing negative returns for the year as diversification benefits have been muted. Our view leading into the final quarter of the year reflected a constructive but more cautious assessment of equity markets. As such, we took actions in late September to position against rising risk, including lowering our exposure to the highly valued technology sector into broader exposures. Nevertheless, the speed, severity and breadth of the downturn have resulted in indiscriminate selling across all equities reducing the effectiveness of our risk-reduction moves.

While it is arguably too simplistic or naïve to pinpoint the exact catalysts for a market decline, the current pull back appears to have been, at least initially, a reflection of slowing economic growth as the US economy began to decelerate from above average levels of growth coupled with the continued normalization of monetary policy by the Federal Reserve. Layer in messy political dynamics in Washington, few signs of progress on the US-China trade front, and you had the ingredients for increasing volatility in stocks. A deep level of uncertainty coupled with tightening financial conditions driven by the Federal Reserve (increased Federal Funds and a shrinking balance sheet), higher credit spreads and more recently, the potential negative feedback loop to the economy from falling asset prices has called into question the viability of the current economic expansion. The question for investors is two-fold: are the risks of recession rising and are markets now adequately discounting risk?

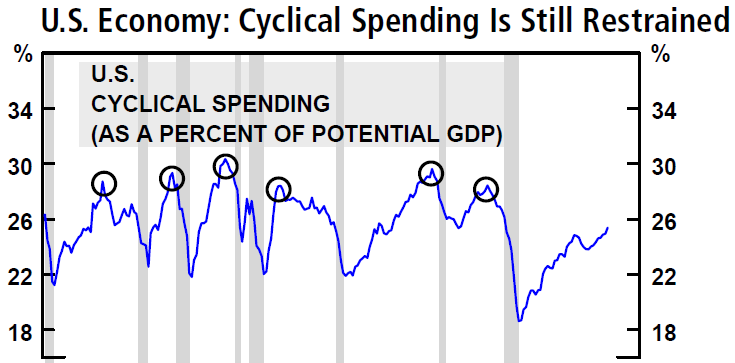

Consistent with our partners at BCA Research, we recognize the risk of recession has risen over the course of the fall. However, comparisons to the lead up to prior recessions are challenged by healthier underpinnings in the current economy, particularly with respect to the US consumer. In contrast to prior recessions, consumer leverage has declined meaningfully, the savings rate is positive and employment trends remain healthy, as evidenced by Friday’s December employment report. Likewise, cyclical spending (residential investment, business capital expenditures and consumer durables) remain well below prior business cycle peaks. While indicators such as the ISM Manufacturing and Non-Manufacturing Indices have declined recently, they are coming off elevated levels and they remain above 50, signifying continued expansion, albeit at a more moderate pace.

Source: BCA Research

While the outlook for international economies is less clear, monetary policy remains accommodative in developed markets, although the capacity to simulate growth is muted. China has taken multiple steps with respect to stimulus, which while muted in comparison to past stimulus measures, has driven a positive inflection point in credit impulse which should drive a pickup in growth in the second half of 2019. A pickup in China would be supportive for emerging and international developed markets alike.

The magnitude and breadth of the decline in stocks has resulted in a meaningful compression in valuations across the globe. At these levels, markets appear to be discounting a deeper slowdown/recession than is warranted by the current economic data. However, valuations, while below long-term averages, remain above levels traditionally signaling bear market bottoms. The future path of the economy and thus earnings is critical to near term equity return expectations given an economy in its later stages. Longer term, the compression in valuations boosts future return expectations.

In assessing the outlook for the economy and thus earnings and asset prices, monetary policy is a critical variable. Chairman Powell has been intentional, in our view, in pushing the market off of the view, or expectation, of a continued “Greenspan/Bernanke/Yellen Put”. However, a further slowing of lead economic indicators coupled with slowing inflation would likely lead a data dependent Fed to pause on further rate hikes in support of their stated mandate of growth and inflation. Current market expectations, in fact, suggest the potential of a rate cut in the second half of 2019.

With respect to the US dollar, the convergence of growth rates between the US and international economies coupled with US Dollar Purchasing Power Parity at extended levels should push the US Dollar lower. A weakening US Dollar would be a net positive for emerging markets and commodities as liquidity shifts at the margin towards the global economy.

Political tensions remain a headwind for the markets and the economy. While the government shutdown creates negative headlines for markets, the historical evidence with respect to the impact to the economy is benign. However, a protracted shutdown could challenge the historical comparison. Trade is clearly a more challenging issue. While the puck keeps moving with respect to the direction of trade negotiations, increasing trade tensions remains a clear challenge for the global economy and the markets.

So where does the above leave us with respect to investment portfolios? Periods of market volatility similar to the last three months test the resolve of investors, professionals and individuals alike. It is during these periods of conflicting signals in the market and economy where we would argue that George Bernard Shaw’s adage holds true for investment portfolios as well: building the appropriate asset allocation remains the most critical determinant of any investor’s ultimate investment “success” over the long term. Our advice, and the actions that we have taken in client portfolios follow three primary themes: maintaining allocations in line with strategic targets, upgrading quality given broad-based declines across asset classes and actively harvesting losses at year-end to manage or minimize capital gains.

The combination of stable economic underpinnings, a data dependent Federal Reserve, negative sentiment, attractive valuations levels and oversold market technical indicators continue to argue for maintaining long term exposure to equities. However, the current decline in stocks has resulted in many high-quality stocks appearing to be “on sale”. When high-quality large cap stocks such as Apple decline 40% from their summer highs and leading businesses such as UPS sell at 12x earnings with ~4% dividend yields, our bias is to upgrade the quality of our equity exposure. As a result, we have lowered our exposure to Master Limited Partnerships (MLP’s) in certain instances with the proceeds redeployed into large cap US stocks. While our outlook on MLP’s remains constructive, the ability to shift into businesses with higher quality balance sheets at comparable valuations is compelling. Similarly, the decline in stocks coupled with relatively tight credit spreads suggest risk is likely to be better rewarded in stocks than lower quality credit investments. We have eliminated our position in bank loans with proceeds being selectively added into equity markets. Finally, we have sold positions in the Wisdom Tree hedged equity ETF’s given an expectation of a modestly weaker US Dollar over the intermediate term.

As we look forward, we will continue to look to balance the opportunities that are presented in a volatile market with the risk associated with the latter stages of an economic and market cycle.