At Heritage we believe uncertain times offer opportunities to proactively reinforce your financial position and prepare for the future.

The start of 2025 has brought renewed economic uncertainty. Proposed tariffs, heightened inflation, interest rate swings, and volatility across equity and fixed income markets have created challenges for investors.

This month the House Ways and Means Committee released an updated tax proposal for debate within the Republican controlled House of Representatives. The proposed legislative package is intended to extend and expand upon the 2017 Tax Cuts and Jobs Act (TCJA) through the budget reconciliation process. For lawmakers, the current hope is that this process will be completed by the end of May and gain Senate approval next month.

While the outcomes remain uncertain and proposals are changing daily, we will try to provide relevant updates for our clients. We encourage you to reach out to discuss how these changes could affect your financial situation and potential opportunities to consider.

We have outlined the key provisions in the proposed bill that may impact financial planning. Below are the most notable items under discussion:

Permanent Extension of 2017 Tax Cuts and Jobs Act Provisions

- Individual Tax Cuts: The bill seeks to make permanent individual tax cuts from the TCJA, which are set to expire at the end of 2025. This includes maintaining lower marginal tax rates, increased alternative minimum tax (AMT) thresholds and the expanded standard deduction. The President has said recently he may be open to higher rates for taxpayers with incomes above $2.5 million per year although not included in the current proposals.

- Child Tax Credit: Continuation of the doubled child tax credit. Including an increased tax credit of $2,500 for years 2025 through 2028.

- Pass-Through Business Deduction: Extends the 20% deduction on qualified business income from pass-through entities. Recent proposals include increasing the deduction to 23% that would effectively create a 28.5% top marginal rate versus 37% for ordinary income. – This is a big one in our view and has been a major benefit for many business owners and investors in flow-through entities. Without an extension, these taxpayers could see significantly higher rates starting in 2026.

Select New Tax Provisions Under Consideration

- Seniors: A temporary deduction of $4,000 for Seniors making less than $150,000 per year ($75,000 for individuals) only applicable through 2028. Previous proposals included an elimination of tax for social security benefits paid to Seniors.

- Tips and Overtime: Makes tips and overtime pay exempt from federal taxation with income threshold phaseouts.

- Auto Loan Interest: Allows an above-the-line deduction for interest on loans for automobiles with income threshold phaseouts.

- State and Local Tax Deduction (SALT): Raises the cap from $10,000 to potentially $30,000. This may increase the likelihood higher earners may itemize deductions again if they weren’t in previous years. Especially for those with multiple properties and high real estate taxes. The proposed cap is intended to be limited to income earners below $400,000 a year. – This is relevant for taxpayers we have been strategically “bunching” deductions in prior years to maximize the standard and itemized deductions. This may also impact those using the Pass-Through Entity Tax (PTET), which is also set to expire in many states by 2025 and would be disallowed for federal purposes.

- Itemized Deductions Limitation: A proposal to limit the benefit of itemized deductions from 37% to 35% after a taxpayer has entered the 37% marginal tax bracket. – This is relevant for high earners who may make large charitable donations on an annual basis, itemizing high mortgage interest, etc. The net benefit of those deductions will decrease on the margin.

Private Foundations

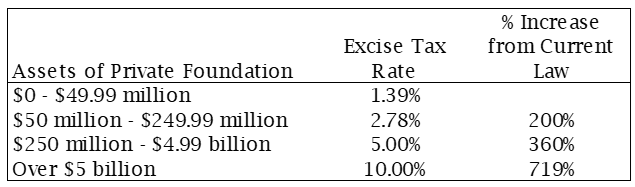

- Tax on Net Investment Income: Sec. 112022 outlines an amendment to the current tax on net investment income for tax-exempt private foundations to a tiered system. The updated tier would be as follows:

Corporate Related Proposals

- Corporate Tax Rate: No changes proposed, but as a reminder, those provisions did not expire at the end of 2025.

- Bonus Depreciation: A proposal to reintroduce 100% bonus depreciation for business investment.

Estate Planning Implications

- The current federal estate and gift tax exemption is at a historic high ($13.61 million per person in 2025). However, unless Congress acts, these exemptions are scheduled to drop by about half at the end of 2025.

- The bill aims to make these higher exemptions permanent, though the possibility of a full estate tax repeal remains low. The latest proposal includes making permanent a $15 million per individual ($30 million per married couple) estate tax lifetime exemption.

Other Considerations

- Costs: The preliminary estimates are that the net cost of the cuts are between $3 to $4 trillion over a ten-year time frame. Overall, the bill continues to add to the national debt. There may be implications for inflation and the U.S. Treasury market over time. We continue to monitor these factors closely in our investment strategies.

- Import Tariffs: Proposals on U.S. imports through new tariffs. This topic remains very fluid as the administration is negotiating trade deals with countries including our largest trading partners. The anticipated revenue raising component of the tariffs may help to decrease the budget gap but is not part of the reconciliation bill.

We hope this update was informative, and we will continue to provide timely updates as we learn them. If you have any immediate questions or we can be helpful with planning for your family, please do not hesitate to reach out to your client service team.