“No major institution in the US has so poor a record of performance over so long a period as the Federal Reserve, yet so high a public reputation.” – Milton Friedman

“One important effect of Goldilocks thinking is that it creates high expectations among investors and thus room for potential disappointment (and losses).” – Howard Marks

What a difference a year makes, or even a quarter. We came into 2023 on the heels of a significant correction in equity (carnage in certain areas) and bond markets. The Federal Reserve continued to position for further interest rate increases to mute inflation pressures, ultimately increasing interest rates four times through July. Fast forward to January, and the backdrop is decidedly different. Equity markets rebounded significantly, led initially by the Magnificent 7, with modest follow-through from the broader market during the fourth quarter.

Our CEO, Dee Ann Remo, appropriately reminds us that if you extend your point of reference from one year to two, equity markets have been “on an interesting trip to nowhere.” Expectations of a “Fed pivot” drove interest rates down in the fourth quarter, resulting in the 10-year US Treasury ending the year effectively where it began.

Consensus now anticipates a soft landing for the economy with modest growth, allowing for lower inflation and interest rates, a “Goldilocks” scenario for financial assets. During times of optimism and complacency, we are conditioned to analyze underlying market and economic conditions from a more skeptical perspective with an eye toward long-term returns.

A quarter ago, we wrote with respect to expectations for equity markets, “… [the] path requires accelerating earnings to validate current growth expectations and extended valuations – a high bar in the face of higher rates, moderating fiscal stimulus, and falling excess savings on consumer balance sheets.” While long-term interest rates are lower, underlying economic trends remain relatively weak – leading indicators have declined for twenty consecutive months, credit card delinquencies are rising, interest coverage ratios are deteriorating for the least credit-worthy borrowers, and housing affordability continues to deteriorate.

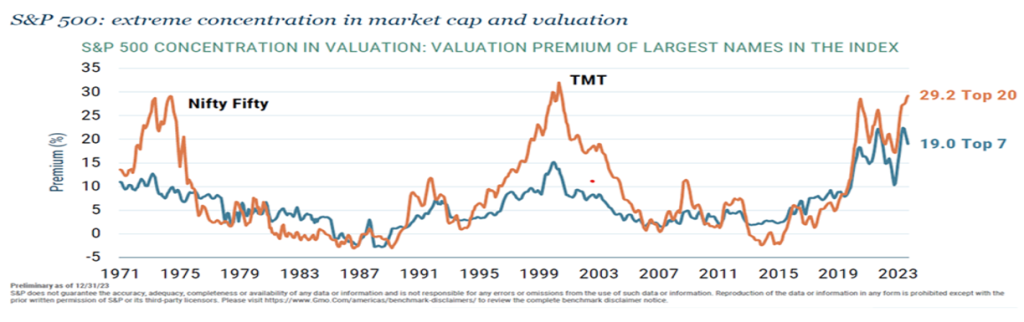

The Federal Reserve is walking a tightrope. The market is betting they will succeed. For equity markets and earnings expectations, they must succeed. Additionally, we have written at length about the risks inherent in the S&P 500 index, given the concentration of the index in a limited number of stocks. As the chart below depicts, the largest stocks in the index, representing a historically high percentage of the index, sell at premiums only seen during prior periods of excess in the market.

Against this backdrop, we continue to emphasize a portfolio of businesses with achievable long-term earnings expectations and reasonable valuations.

Similar to the equity markets, Goldilocks is alive and well in the fixed-income markets. Statements from the Federal Reserve effectively ending the rate tightening cycle and forecasting rate cuts in the second half of 2024 pushed interest rates down a full percentage point in the fourth quarter.

Going forward, underlying economic and inflation trends will dictate the path of interest rates. With a nod to our partners at BCA Research, a material decline in interest rates will likely require rising unemployment. In contrast, a material increase in rates will require an acceleration in inflation. We took modest steps to increase the duration in fixed-income portfolios in the fourth quarter at higher rates. Importantly, even after declining rates in the fourth quarter, investors can earn attractive returns (4-5%) in high-quality bonds.

We are starting the year with the mirror image of a year ago – confidence in the Federal Reserve and its ability to engineer a soft landing is high. At the same time, the market appears numb to geopolitical risks around the world. While we remain optimistic about the long-term prospects for the economy, we are comfortable looking different from the consensus when market risks appear to be elevated. History suggests protecting capital during more challenging environments allows for longer-term returns with less volatility. We will continue to act as stewards of our client’s assets and lean against perceived risks in financial markets while remaining flexible to take advantage of opportunities.

Please do not hesitate to contact your wealth advisor or a member of the Investment Advisory team with any questions.