Utilizing a Health Savings Account (HSA) is an easy way to supplement your health insurance plan as well as accomplish some planning goals. The name Health Savings Account is self-explanatory in that it is a savings account that can be used to cover medical expenses.

What sets the HSA apart from a regular savings account is that it has numerous tax benefits that have the potential to make a substantial impact on your short and long-term tax bill. The first benefit is that these accounts are funded with pre-tax dollars, so, similar to a 401(k), you won’t pay any tax on your contributions to the account in the year that you contribute. The second benefit is that if the HSA is used to pay for qualified medical expenses, you won’t pay any tax on any withdrawals. The funds are tax-free going in and tax free when withdrawn.

Additionally, unlike a Flexible Savings Plan (FSA) where you must use these funds by the end of each year, contributions to an HSA never expire. This allows you, and your employer, to contribute frequently and build up a nest egg to use for any planned or unplanned medical expenses.

Eligibility and Limits

In order to enjoy the tax benefits of a health savings account, you must be enrolled in a High Deductible Health Plan (HDHP). The IRS considers an insurance plan an HDHP when it has a minimum deductible of $1,350 for individuals and $2,700 for family coverage.

Your contributions to an HSA are pre-tax, therefore there are limitations on the amount that you can contribute each year. For 2019, the limit for individuals is $3,500 and $7,000 for families. Individuals over age 55 can make an additional $1,000 “catch-up” contribution.

As mentioned, HSAs must be used for qualified medical expenses. If used for a non-qualified expense, the funds will be fully taxable and incur a 20% penalty. The only exception to this rule is that after age 65, the 20% penalty no longer applies.

The IRS provides an extensive list of qualified medical expenses on their website. These qualified expenses generally include any costs related to your doctor, dentist, health insurance, etc.

Short-term Strategy

Under current tax law, you are able to deduct your medical expenses that exceed 7.5% of your adjusted gross income. Often this is a tough hurdle to overcome, especially for those who are still working and have more taxable income. After the 2018 Tax Cuts and Jobs act, which doubled the standard deduction, more taxpayers are taking the standard deduction rather than itemizing. This adds another potential hurdle when trying to deduct your medical expenses on your tax return.

Using an HSA to cover your qualified medical expenses eliminates that 7.5% hurdle rate and allows you to take a full deduction, whether you itemize your deductions or not. As an example, say you are in the 24% federal tax bracket and live in Virginia. Your total marginal Federal and State income tax rate would be 29.75%. If you contributed $1,350 in an HSA and used it to cover your annual deductible, you would save $401 in taxes.

Long-term Strategy

Since unused HSA funds can be rolled over from year to year, the account can be used as a long-term tax saving strategy. We know that as we age, we are likely to need more medical attention, while at the same time health care costs continue to rise. It is hard to imagine how much we may need to spend on medical costs throughout our retirement. According to a 2018 study, the Fidelity Health Care Cost Estimate, the average couple retiring at the age of 65 will spend about $280,000 on medical expenses throughout retirement. This amount excludes any expenses covered by Medicare.

When used over the long-term, a health savings plan can help mitigate these costs while saving on taxes in three ways:

- Contributions are pre-tax

- Any growth in the account is tax-free

- Withdrawals for qualified medical expenses are tax-free

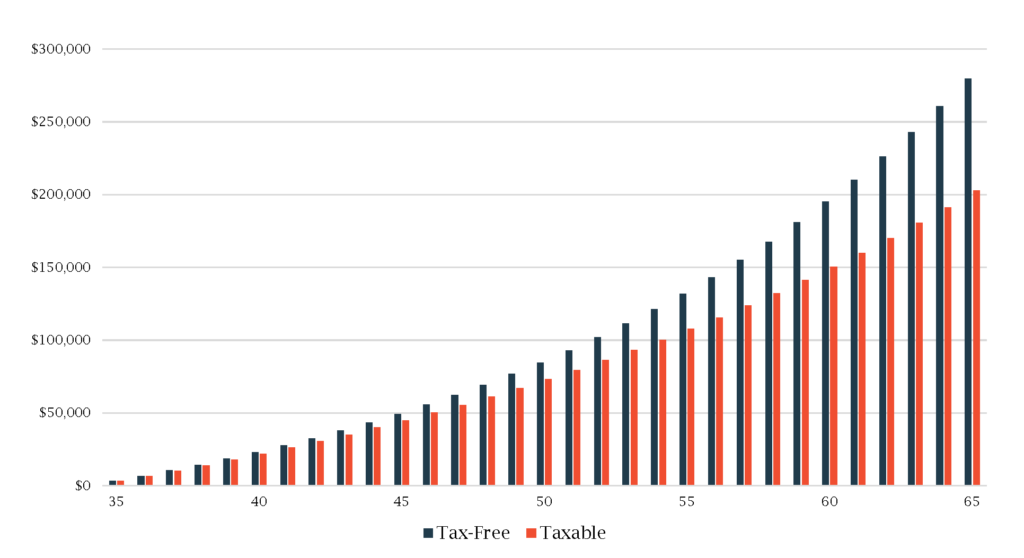

Similar to an IRA, you can invest an HSA across a range of asset classes. The funds do not have to be held in cash. The tax-free growth aspect is what can really accelerate the value over time. The chart below illustrates an example of an annual $3,300 contribution with an annual 6% growth rate, compared to after tax dollars.

Under these assumptions, $280,000 would have been saved by age 65, which is about $80,000 more than a taxable account. Starting at age 65, the HSA essentially turns into an IRA. The 20% penalty on non-qualified expenses is eliminated, so these funds can be used for medical or non-medical expenses. Withdrawals for medical expenses will always be tax-free, while any other withdrawals will be taxable, just like an IRA.

In addition to the tax benefits of an HSA, the IRS allows you to reimburse yourself for previous out-of-pocket medical expenses incurred after an HSA has been established. This means that if you track all qualified, unreimbursed medical expenses, you can take one large, tax-free withdrawal later in life to cover those previously incurred costs. The goal of this strategy is to allow the HSA to grow over time, as seen in the chart above, and use the earnings to cover previous medical expenses. To comply with the IRS while utilizing this strategy, you will need to have documentation to support those previous medical expenses and show that they occurred while the HSA was open. The expenses also cannot have been deducted on a previous year’s tax return.

Whether using an HSA to save for medical expenses in retirement, or just covering annual copays and prescriptions, it can be a great addition to your overall financial plan. We would welcome the opportunity to discuss how an HSA may fit into your individual tax and long-term financial plan.

Additional Resources

Fidelity Viewpoints: How to plan for rising health care costs

This material has been prepared for general informational purposes only and is not intended as a substitute for a formal opinion, nor is it sufficient to avoid tax related penalties. If desired, Heritage Wealth Advisors would be pleased to perform specific research and provide detailed professional advice.