When families think about supporting the rising generation, whether it’s helping with a home purchase, funding a business, or bridging a liquidity event, an intrafamily loan can be an elegant solution. Unlike an outright gift, a properly structured loan keeps capital in the family while creating opportunities for wealth transfer and tax efficiency.

For high net-worth families, this approach can be a cornerstone of estate planning, allowing appreciation to move outside the lender’s taxable estate without utilizing lifetime exemptions.

Why Intrafamily Loans Appeal to Wealth-Building Families

One of the biggest advantages? The interest cost. Traditional lenders often charge higher rates, require underwriting, and may charge unnecessary fees. When families have accumulated large pools of capital and are willing to lend to each other, they can leverage the family balance sheet in unique ways and cut out the need for traditional lenders.

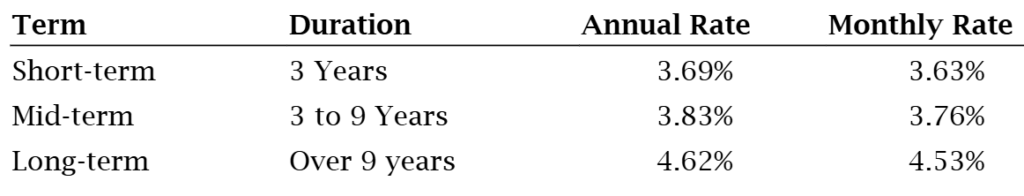

As of November 2025, the IRS Applicable Federal Rates (AFRs) – the minimum rates required to avoid gift tax issues – are as follows:

Compare that to current 30-year mortgage rates hovering between 6.25%–7%. On a $1 million home loan, borrowing at 4.5% instead of 7% could save tens of thousands in interest over time. While AFR rates are higher than they were in 2021, when interest rates bottomed, current levels remain attractive for intrafamily lending.

At Heritage, our investment and planning teams continue to monitor the movement of interest rates and policy decisions. Recent action by the Federal Reserve Open Market Committee (FOMC), resulted in the discount rate being reduced to 3.75% to 4%, while longer term rates, which are more dependent on multiple factors, remain stickier.

How to Structure an Intrafamily Loan Correctly

To qualify as a legitimate loan, you need a written promissory note, a fixed repayment schedule, and interest at or above the AFR. The lender reports interest income, and the borrower may be eligible to deduct interest if the loan is secured by a qualified residence or used for business purposes. Proper documentation helps substantiate the loan for tax purposes and supports compliance with estate and gift tax rules. Tax treatment matters.

A Strategic Way to Build Legacy and Preserve Family Capital

At the end of the day, intrafamily loans aren’t just about numbers, they are about values. They allow families to deploy wealth strategically, helping loved ones achieve milestones while keeping capital in the family ecosystem.

For families with significant assets, this approach can be an elegant way to balance generosity with discipline, advancing next-generation goals while preserving the integrity of the family balance sheet.

In our experience, intrafamily loans work best when thoughtfully integrated into a broader plan that considers cash flow, estate, and investment objectives across generations.

If you are considering whether an intrafamily loan could complement your estate or liquidity planning, our advisory team can help you evaluate the right structure for your family.